This article explores the crucial role of smart contracts in the cryptocurrency ecosystem. We will delve into how these self-executing contracts, secured by blockchain technology, are revolutionizing various aspects of cryptocurrency transactions, including decentralized finance (DeFi), NFT marketplaces, and supply chain management. Understanding the functionality and implications of smart contracts is essential for anyone navigating the increasingly complex world of digital assets and blockchain applications. We will examine both the benefits and limitations of this groundbreaking technology, offering a comprehensive overview of its impact on the future of cryptocurrency.

What Are Smart Contracts?

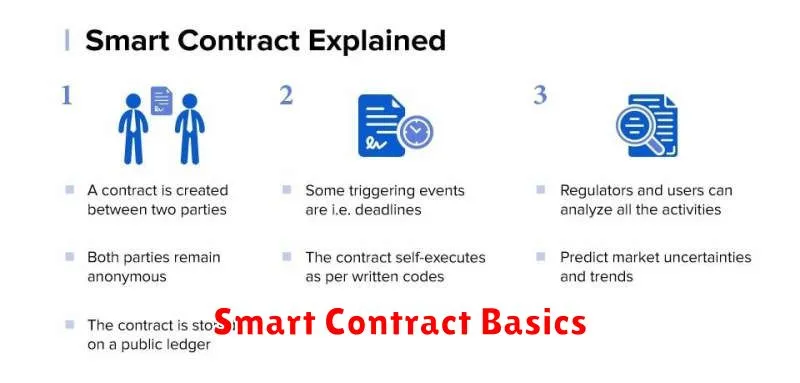

Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. They are stored on a blockchain, a decentralized and transparent ledger.

Unlike traditional contracts that rely on intermediaries for enforcement, smart contracts automatically execute when predefined conditions are met. This automation eliminates the need for trust in third parties and reduces the risk of fraud or delays.

Key features include immutability (once deployed, the code cannot be altered), transparency (all transactions are visible on the blockchain), and security (secured by cryptographic principles).

Examples of their use include escrow services, supply chain management, and decentralized finance (DeFi) applications.

How Do Smart Contracts Work?

Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. They are stored on a blockchain, a decentralized and immutable ledger.

When pre-defined conditions are met, the contract automatically executes, transferring assets or information as stipulated. This automation eliminates the need for intermediaries, reducing costs and increasing efficiency. The code itself acts as a guarantor, ensuring the agreement’s terms are enforced without human intervention.

Triggers initiate the execution of a smart contract. These triggers can vary widely, from a specific date and time to the completion of another transaction on the blockchain. Upon triggering, the contract’s code performs the defined actions, such as transferring cryptocurrency, releasing funds into escrow, or registering ownership changes.

The decentralized nature of blockchains ensures transparency and security. All transactions and contract executions are recorded on the blockchain, making them publicly auditable and resistant to tampering. This offers a higher degree of trust compared to traditional contracts, which rely on intermediaries for enforcement.

While offering significant advantages, it’s crucial to understand that smart contracts are only as good as the code that governs them. Bugs or vulnerabilities in the code can lead to unintended consequences or even malicious exploitation. Thorough auditing and testing are essential before deploying a smart contract.

Ethereum and Smart Contracts

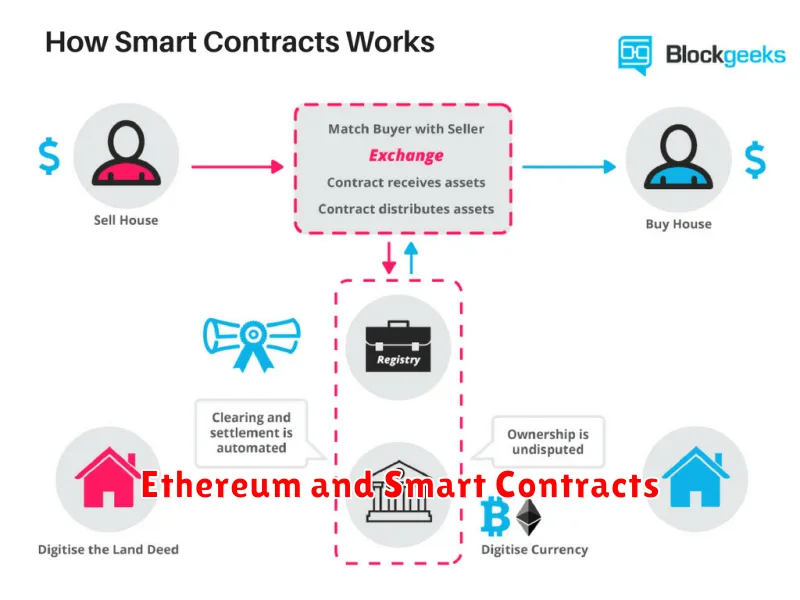

Ethereum is a decentralized platform that utilizes blockchain technology to facilitate the creation and execution of smart contracts. These contracts are self-executing agreements with the terms of the agreement directly written into code.

The decentralized nature of Ethereum ensures transparency and immutability, meaning all transactions and agreements are recorded on a public, verifiable ledger. This eliminates the need for intermediaries and reduces the risk of fraud or manipulation.

Smart contracts on Ethereum automate various processes, such as transferring funds, managing digital assets, and enforcing agreements. This automation improves efficiency, security, and trust in transactions.

The Ethereum Virtual Machine (EVM) is a crucial component, providing a sandboxed environment for the execution of smart contracts, ensuring security and preventing interference from external factors.

Solidity is the most commonly used programming language for developing smart contracts on the Ethereum platform. Its features are designed for creating secure and reliable code.

Advantages of Smart Contracts

Smart contracts offer several key advantages in the cryptocurrency landscape. One primary benefit is increased security; they operate autonomously based on pre-defined rules, eliminating the need for intermediaries and reducing the risk of fraud or human error.

Another significant advantage is transparency. All transactions and agreements are recorded on a public, immutable blockchain, enhancing accountability and trust among parties.

Efficiency is also a major benefit. Smart contracts automate processes, reducing delays and costs associated with traditional contractual methods. This automation leads to faster transaction processing and reduced administrative overhead.

Furthermore, smart contracts provide enhanced accuracy. By executing pre-programmed instructions, they minimize the possibility of ambiguity or errors in contract interpretation, leading to more precise and reliable agreements.

Finally, the decentralized nature of smart contracts ensures greater autonomy for all parties involved. No central authority controls the execution of the contract, giving each participant greater control over their own assets and agreements.

Risks and Limitations of Smart Contracts

Despite their potential, smart contracts are not without risks and limitations. One major concern is the possibility of bugs or errors in the code. A flaw in the smart contract’s logic can lead to unintended consequences, potentially resulting in significant financial losses or the compromise of sensitive data.

Security vulnerabilities are another critical limitation. Smart contracts are susceptible to hacking and malicious attacks, particularly if not properly audited and secured. Exploits can allow attackers to manipulate the contract’s functionality for their own gain.

The lack of legal clarity surrounding smart contracts presents a significant challenge. The enforceability of smart contracts in various jurisdictions remains uncertain, making it difficult to resolve disputes arising from contract breaches.

Oracle problems pose a considerable risk. Smart contracts often rely on external data feeds (oracles) to trigger events. If the oracle data is inaccurate or manipulated, it can lead to incorrect execution of the smart contract.

Finally, the immutability of smart contracts, while a desirable feature in some contexts, can also be a limitation. Once a smart contract is deployed, it cannot be easily modified or updated, making it difficult to address unforeseen issues or vulnerabilities.

Popular Use Cases of Smart Contracts

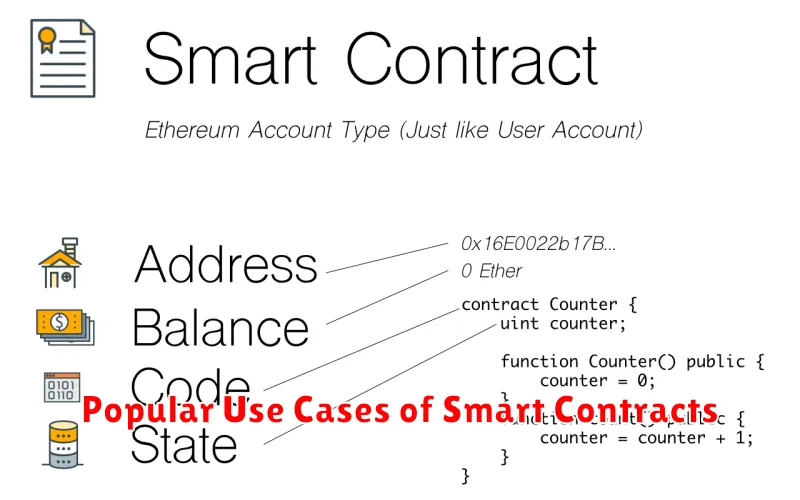

Smart contracts find widespread application within the cryptocurrency ecosystem, automating various processes and enhancing security and transparency. Decentralized Finance (DeFi) is a major use case, enabling peer-to-peer lending, borrowing, and trading without intermediaries. This includes applications like automated market makers (AMMs) and decentralized exchanges (DEXs).

Supply chain management benefits significantly from smart contracts. Tracking goods and verifying authenticity becomes simpler and more secure, reducing fraud and improving efficiency. Each stage of the supply chain can be recorded immutably on a blockchain, enhancing transparency and accountability.

Digital asset management is another key area. Smart contracts facilitate secure and automated handling of non-fungible tokens (NFTs), including creation, sales, and royalty distribution. This streamlines the process and reduces reliance on centralized platforms.

Beyond these prominent examples, smart contracts are used for voting systems, ensuring secure and transparent elections; digital identity management, allowing users to control their own data; and insurance, automating claims processing and reducing disputes.

The versatility and security of smart contracts continue to drive innovation in various sectors, expanding their potential applications within the cryptocurrency world and beyond.

Security Risks in Smart Contracts

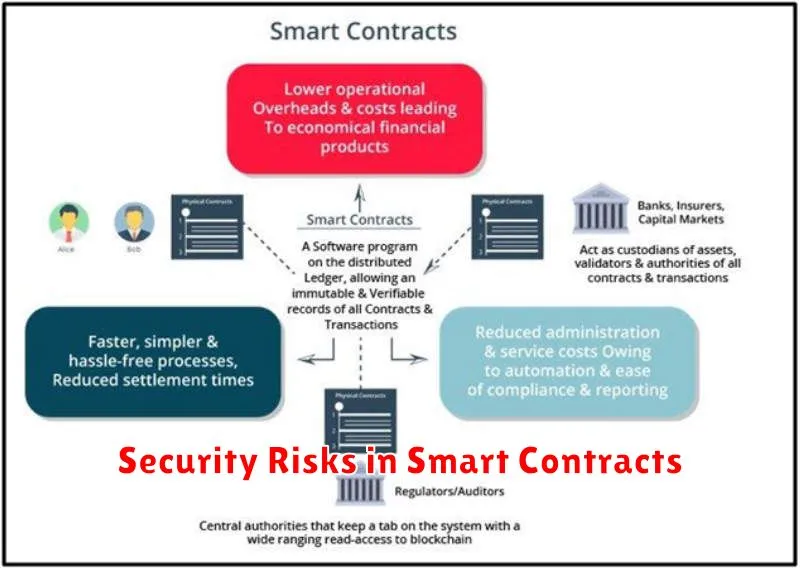

Smart contracts, while offering automation and transparency, present significant security risks. These risks stem from the immutable nature of blockchain technology; once deployed, code is difficult to alter or fix.

One major concern is reentrancy attacks. These exploit vulnerabilities in how contracts handle external calls, allowing attackers to drain funds by repeatedly triggering a function.

Logic errors in the contract code itself can also lead to significant vulnerabilities. Careless coding can create unintended consequences, allowing for exploitation and loss of funds.

Denial-of-service (DoS) attacks can disrupt the functionality of a smart contract by flooding it with requests, rendering it unusable.

Third-party libraries incorporated into smart contracts can introduce vulnerabilities if those libraries themselves are compromised. Auditing all dependencies is crucial for security.

Insufficient access control, failing to properly restrict who can interact with certain functions, can grant unauthorized individuals excessive privileges.

Addressing these security concerns requires rigorous code auditing, thorough testing, and employing best practices in smart contract development. The inherent risks necessitate a cautious and meticulous approach to ensure the integrity and security of smart contracts.

How to Audit a Smart Contract

Auditing a smart contract requires a multi-faceted approach focusing on security, functionality, and compliance. The process typically begins with a thorough review of the contract’s source code.

Static analysis tools are employed to identify potential vulnerabilities without executing the code. This involves checking for common flaws like reentrancy, arithmetic overflows, and race conditions. Simultaneously, a manual review is crucial to understand the logic and design of the contract.

Dynamic analysis follows, which involves testing the smart contract in a controlled environment to verify its behavior under various conditions. This may involve simulating user interactions and different scenarios to identify unexpected outcomes or vulnerabilities.

Formal verification, a more rigorous method, mathematically proves the correctness of the contract’s functionality against its specifications. This is often used for high-value or critical contracts where absolute certainty is paramount.

Throughout the audit, meticulous documentation is key. This includes a detailed report outlining the methodology, findings (both vulnerabilities and positive aspects), and recommended solutions. The audit report should be clear, concise, and easily understandable by both technical and non-technical stakeholders.

Finally, engaging a reputable and experienced auditing firm is highly recommended, especially for complex smart contracts. Their expertise ensures a thorough and reliable assessment, mitigating potential risks and building trust.

Future of Smart Contracts

The future of smart contracts is bright, driven by advancements in several key areas. Increased interoperability between different blockchain networks will allow for more seamless and efficient transactions across platforms. This will involve improvements in cross-chain communication protocols and the development of universal standards.

Enhanced security is another crucial aspect. Future smart contracts will likely incorporate more robust security measures, including advanced cryptography and formal verification techniques, to mitigate vulnerabilities and prevent exploits. This includes exploring and implementing quantum-resistant cryptography to address future threats.

The development of more sophisticated programming languages and development tools will make creating and deploying smart contracts easier and more accessible to a wider range of developers. This will lead to more innovative and complex applications.

Decentralized oracle networks are set to play a more significant role, providing reliable off-chain data feeds to smart contracts. This improved integration with the real world will enable the creation of even more powerful and useful applications.

Finally, we can expect to see greater regulation and standardization in the smart contract space. This will increase trust and adoption, making them more suitable for mainstream use in various industries beyond finance.