Navigating the dynamic world of cryptocurrency can feel daunting, especially for beginners. This beginner’s guide to understanding crypto market trends will equip you with the essential knowledge to make informed decisions. We’ll explore key factors influencing crypto prices, including market capitalization, trading volume, blockchain technology, regulation, and adoption rates. Learn how to identify bull and bear markets, understand the impact of Bitcoin and altcoins, and develop a basic strategy for navigating the volatility inherent in the cryptocurrency market. Unlock the potential of this exciting asset class by mastering the fundamentals of crypto market analysis.

How Crypto Market Trends Work

Crypto market trends are driven by a complex interplay of factors, making them notoriously volatile. Supply and demand are fundamental; increased demand relative to supply pushes prices up, and vice versa. Investor sentiment, influenced by news, social media, and regulatory developments, significantly impacts price movements. A positive outlook leads to buying pressure, while negative news can trigger sell-offs.

Technological advancements within the crypto space, such as new blockchain protocols or improved scalability solutions, can generate excitement and attract investment, boosting prices. Conversely, security breaches or regulatory uncertainty can negatively impact investor confidence and lead to price declines.

Macroeconomic factors also play a crucial role. Events such as inflation, interest rate changes, and geopolitical instability can influence investor risk appetite, affecting the entire crypto market. The correlation between crypto assets and traditional markets, while variable, can be significant during periods of market stress.

Finally, market manipulation, though often difficult to detect and prove, can influence short-term price movements. Large-scale coordinated buying or selling can artificially inflate or deflate prices.

Bull vs Bear Market in Crypto

Understanding the difference between bull and bear markets is crucial for navigating the volatile world of cryptocurrency. A bull market is characterized by rising prices and widespread optimism. Investors are confident, buying assets in anticipation of further price increases. This period often involves significant price appreciation and high trading volume.

Conversely, a bear market is defined by declining prices and pessimism. Investors are selling assets, expecting further price drops. This is typically marked by a significant decrease in price and trading volume. Fear and uncertainty dominate the market sentiment during a bear market.

Identifying the current market trend – whether bullish or bearish – is vital for making informed investment decisions. While a bull market offers potential for substantial profits, it also carries the risk of significant losses if the market turns. Similarly, bear markets present opportunities for savvy investors to buy assets at discounted prices, but also involve the risk of further price declines.

It’s important to remember that crypto markets are particularly volatile, meaning these trends can shift rapidly. Diversification and a well-defined risk management strategy are crucial for mitigating potential losses in both bull and bear markets.

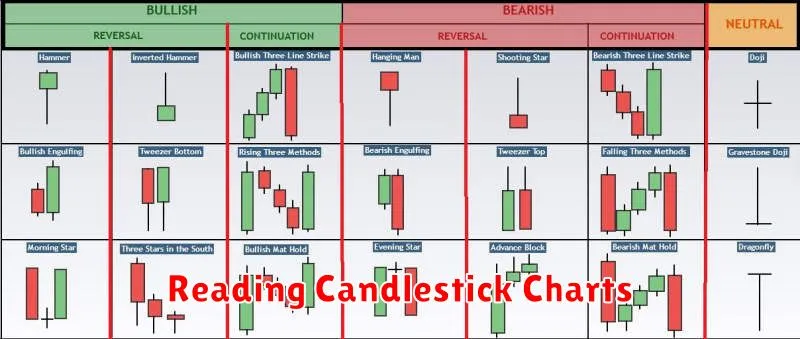

Reading Candlestick Charts

Candlestick charts are a crucial tool for understanding crypto market trends. Each candlestick represents a specific time period (e.g., 1 hour, 1 day), visually displaying the open, high, low, and close prices.

The body of the candlestick shows the range between the open and close prices. A green or white body indicates a closing price higher than the opening price (bullish), while a red or black body signifies a closing price lower than the opening price (bearish).

The wicks (or shadows) extending above and below the body represent the high and low prices reached during that period. Long wicks suggest strong buying or selling pressure that was ultimately overcome.

By analyzing patterns formed by multiple candlesticks, traders can identify potential support and resistance levels, predict price reversals, and spot trending markets. Learning to interpret candlestick patterns enhances your ability to make informed trading decisions.

While candlestick patterns offer valuable insights, they are most effective when used in conjunction with other technical indicators and fundamental analysis for a comprehensive market understanding.

Using Technical Indicators for Trading

Technical indicators are mathematical calculations based on price and volume data, designed to help traders predict future price movements. They are not crystal balls, but can provide valuable insights when used correctly in conjunction with other forms of analysis.

Moving Averages (MAs), such as the simple moving average (SMA) and exponential moving average (EMA), smooth out price fluctuations to identify trends. Relative Strength Index (RSI) measures the magnitude of recent price changes to evaluate overbought or oversold conditions. MACD (Moving Average Convergence Divergence) identifies momentum changes by comparing two moving averages.

Bollinger Bands show price volatility and potential support and resistance levels. Fibonacci retracement levels are used to identify potential support and resistance levels based on Fibonacci sequence ratios. Volume indicators such as On-Balance Volume (OBV) help confirm price trends by analyzing trading volume.

It’s crucial to remember that no indicator is perfect. They should be used in combination with other forms of analysis, including fundamental analysis and chart patterns, to make informed trading decisions. Risk management techniques such as stop-loss orders are essential to protect capital, regardless of the indicators used.

Avoiding FOMO and Emotional Trading

The cryptocurrency market is known for its volatility, leading to intense fear of missing out (FOMO) and emotional decision-making. FOMO, driven by the rapid price increases of certain cryptocurrencies, can lead to impulsive purchases without proper research or risk assessment. This often results in significant losses.

Emotional trading, influenced by fear, greed, or excitement, undermines rational investment strategies. Making decisions based on short-term price fluctuations rather than long-term market analysis is a key characteristic of emotional trading and a major risk factor. To mitigate these risks, prioritize thorough research before investing in any cryptocurrency. Understand the underlying technology, project team, and market conditions.

Develop a well-defined investment plan, including your risk tolerance and investment goals. Sticking to this plan helps avoid impulsive decisions based on market hype. Consider dollar-cost averaging, a strategy that involves investing a fixed amount of money at regular intervals regardless of price fluctuations, to mitigate the impact of FOMO and emotional swings.

Finally, remember that the cryptocurrency market is inherently risky. Patience and discipline are crucial for long-term success. Avoid chasing quick profits, and instead focus on building a diversified portfolio based on solid research and a well-defined strategy.

The Role of Bitcoin in Market Trends

Bitcoin, the world’s first and most well-known cryptocurrency, plays a significant role in shaping broader cryptocurrency market trends. Its price movements often act as a benchmark, influencing the performance of other altcoins.

A bullish Bitcoin market typically leads to increased investor confidence and a general rise in the value of other cryptocurrencies. Conversely, a bearish Bitcoin market can trigger a sell-off across the entire cryptocurrency space. This correlation is driven by several factors, including investor sentiment, regulatory changes, and overall market liquidity.

However, it’s crucial to understand that while Bitcoin’s influence is substantial, it’s not absolute. Individual altcoins can experience price fluctuations independent of Bitcoin’s performance, influenced by their own project developments, technological advancements, and adoption rates. Therefore, while Bitcoin acts as a major indicator, it’s essential to analyze each cryptocurrency individually for a comprehensive market understanding.

Understanding Bitcoin’s role allows investors to better interpret broader market trends and make more informed decisions. Tracking Bitcoin’s price volatility, alongside news and events affecting the cryptocurrency market, provides valuable context for navigating the complexities of the crypto space.

How Crypto Regulations Affect the Market

Cryptocurrency markets are significantly influenced by regulation. Government actions, whether promoting or restricting crypto activities, directly impact investor confidence and market stability.

Favorable regulations, such as clear tax guidelines and licensing frameworks, can boost investor confidence, leading to increased market participation and potentially higher prices. Conversely, restrictive regulations, including outright bans or stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) rules, can decrease market liquidity, drive prices down, and push trading to less regulated jurisdictions.

The uncertainty surrounding future regulations is also a major factor. The evolving regulatory landscape creates volatility as investors react to potential changes. News of upcoming regulations, even if not yet implemented, can trigger significant price swings.

Different jurisdictions having different regulatory approaches creates further complexity. This leads to geographical arbitrage opportunities, where investors move their assets to regions with more favorable regulations. This can influence the overall market dynamics and the relative strength of different cryptocurrencies.

In short, understanding the regulatory environment is crucial for navigating the cryptocurrency market. Regulatory clarity tends to foster stability and growth, while uncertainty and restrictive measures can lead to instability and price fluctuations.

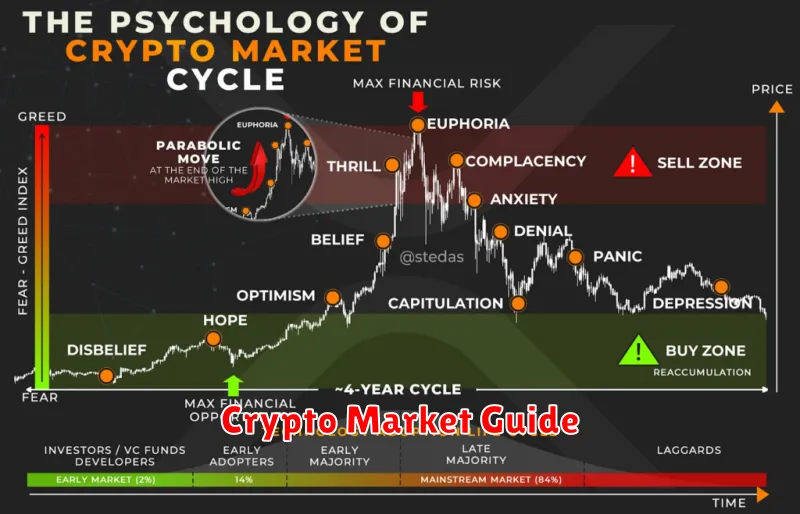

Understanding Crypto Seasonal Cycles

While the cryptocurrency market is notoriously volatile, some seasonal patterns have emerged over time. These aren’t as predictable as, say, retail sales around the holidays, but understanding them can offer some context for price fluctuations.

Historically, the period between November and January has often shown positive momentum, potentially driven by investor interest and year-end bonuses. Conversely, the period following a significant bull run often leads to a market correction, sometimes during the late winter or spring months.

However, it’s crucial to remember these are merely observed trends, not guaranteed outcomes. Numerous other factors—regulatory announcements, technological advancements, macroeconomic conditions—have a far greater impact on crypto prices. Don’t rely solely on seasonal patterns for investment decisions.

Analyzing past performance can be helpful for context, but it’s essential to adopt a holistic approach considering various market indicators and news before making any investment choices. The crypto market is dynamic, and predictions are inherently risky.