Choosing between cloud mining and hardware mining for cryptocurrency can be a daunting task. This article will delve into a comprehensive comparison of both methods, examining their respective pros and cons, including profitability, setup costs, technical expertise required, risk factors, and environmental impact. Ultimately, we aim to help you make an informed decision on which mining approach best suits your individual needs and financial goals regarding Bitcoin, Ethereum, and other cryptocurrencies.

What is Cloud Mining?

Cloud mining is a method of cryptocurrency mining where individuals lease computing power from a data center, rather than purchasing and maintaining their own mining hardware. Instead of owning ASICs or GPUs, users pay a fee to a cloud mining provider for access to their mining equipment and resources. This allows users to participate in cryptocurrency mining without the initial capital investment and operational complexities associated with hardware mining.

Cloud mining providers typically offer various mining contracts with differing durations and hashing power allocations. Users then receive a share of the mined cryptocurrency proportional to their contract’s hashing power. The ease of access and lack of upfront hardware costs are key advantages, however, profitability is heavily dependent on the provider’s fees, the cryptocurrency’s price, and the mining difficulty.

It’s crucial to carefully research and select a reputable cloud mining provider. Transparency and security should be paramount considerations before entering into any contract. Scams and fraudulent operations exist within the cloud mining industry, so due diligence is essential.

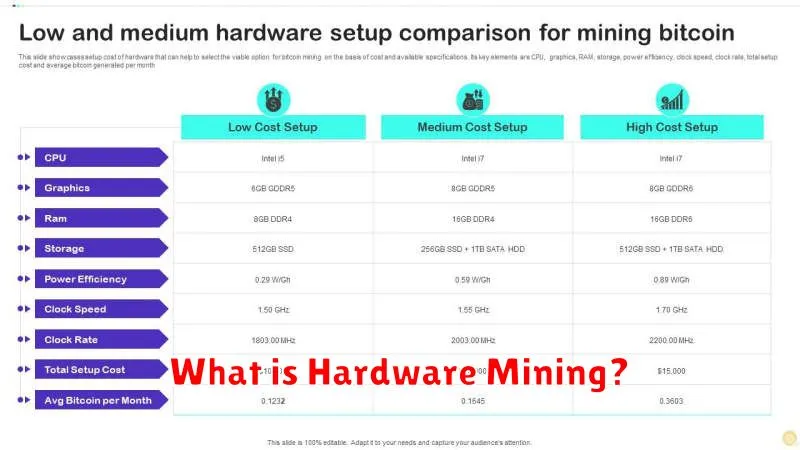

What is Hardware Mining?

Hardware mining involves using specialized computer hardware, such as ASICs (Application-Specific Integrated Circuits) or GPUs (Graphics Processing Units), to solve complex mathematical problems and validate transactions on a blockchain network. This process, known as mining, earns miners cryptocurrency as a reward.

ASICs are specifically designed for mining particular cryptocurrencies, offering superior hashing power and efficiency compared to GPUs. GPUs, while less efficient for some cryptocurrencies, are more versatile and can be used for other tasks besides mining.

Hardware mining requires a significant upfront investment in specialized equipment, along with ongoing costs for electricity and maintenance. The profitability of hardware mining is heavily influenced by factors such as the cryptocurrency’s price, mining difficulty, and energy costs.

Cost Comparison: Cloud vs Hardware

The cost of cloud mining versus hardware mining is a significant factor in choosing a method. Cloud mining involves paying a subscription fee for access to a mining operation’s hashing power. This eliminates the upfront capital expenditure of purchasing mining hardware, electricity, and cooling systems. However, ongoing subscription fees can accumulate over time, potentially exceeding the total cost of hardware mining in the long run.

Hardware mining requires a substantial initial investment in ASIC miners or GPUs, along with the costs of electricity, cooling, and maintenance. These upfront costs are high but are fixed after the initial purchase. The profitability of hardware mining depends heavily on the cryptocurrency’s price, electricity costs, and the mining difficulty. Operational costs continue but are potentially lower than cloud mining fees after the initial investment is recouped.

Therefore, the most cost-effective option depends on several factors, including the time horizon, the cryptocurrency’s price volatility, and the miner’s risk tolerance. A short-term investment might favor cloud mining’s lower barrier to entry, while a longer-term strategy may benefit from the potentially lower long-term costs of owning hardware. Careful consideration of all relevant factors is crucial in determining the most economical approach.

Which Mining Method is More Profitable?

Determining the more profitable mining method—cloud mining or hardware mining—depends on several factors. Hardware mining, while requiring a significant upfront investment in equipment, can potentially yield higher profits in the long run if cryptocurrency prices remain favorable and electricity costs are low. However, it demands technical expertise for setup and maintenance and carries the risk of equipment failure.

Cloud mining offers a lower barrier to entry with smaller upfront costs. Profitability, however, is heavily influenced by the contract terms offered by the cloud mining provider, including the hashing power provided and the contract’s duration. Factors like maintenance, electricity costs, and potential scams are handled by the provider, but profits are typically shared according to the contract terms, resulting in potentially lower returns compared to hardware mining under ideal conditions.

Ultimately, the profitability of each method is contingent on variables like cryptocurrency price fluctuations, electricity costs, hashing difficulty, and the specific terms of a cloud mining contract. Careful analysis of these factors is essential before making a decision.

Security Risks of Cloud Mining

Cloud mining, while offering convenience, presents several security risks. The most significant is the risk of theft. Your cryptocurrency may be vulnerable to hacking or malicious activities by the cloud mining provider or third parties.

Data breaches are another major concern. Your personal information, including login credentials and financial details, could be compromised. This can lead to identity theft and financial loss beyond the loss of cryptocurrency.

Lack of control over the mining hardware and infrastructure is a key security vulnerability. You are reliant on the provider’s security measures, which may not be as robust as you might expect. You have less visibility into the operations and less ability to implement your own security protocols.

Furthermore, regulatory compliance may be uncertain with cloud mining providers operating in jurisdictions with weaker data protection laws, increasing the risk of your data being compromised.

Finally, exit scams, where a provider disappears with users’ funds and resources, are a significant threat in the cloud mining landscape. Due diligence and careful provider selection are crucial to mitigate this risk.

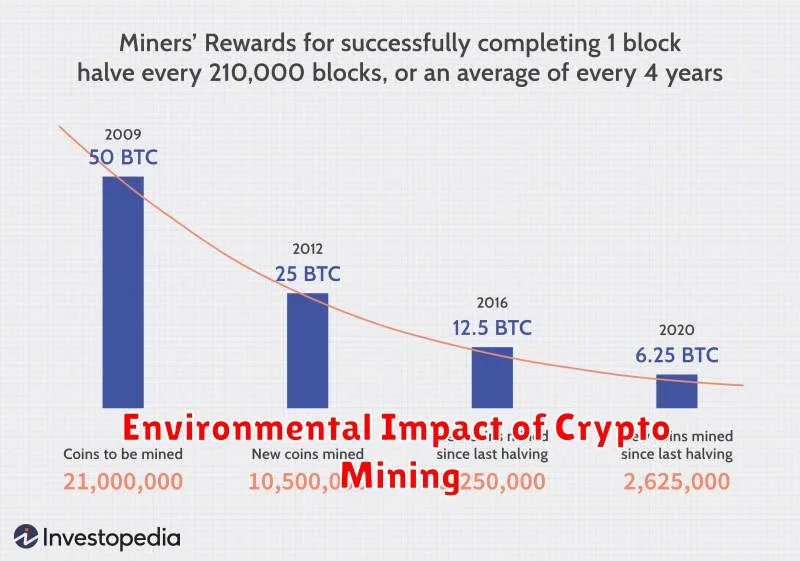

Environmental Impact of Crypto Mining

Cryptocurrency mining, regardless of the method, carries a significant environmental footprint. The process is energy-intensive, requiring vast amounts of electricity to power the complex computational processes needed to validate transactions and mine new coins.

This high energy consumption contributes to greenhouse gas emissions, exacerbating climate change. The electricity often comes from fossil fuel sources, further increasing the environmental impact. The manufacturing and eventual disposal of mining hardware also contribute to electronic waste and resource depletion.

While cloud mining can potentially offer some advantages in terms of energy efficiency by centralizing operations and potentially utilizing renewable energy sources, it doesn’t eliminate the underlying energy consumption. The overall environmental impact depends on the specific practices of the mining operation and the sources of electricity utilized.

Therefore, the choice between cloud mining and hardware mining does not inherently eliminate the environmental concerns. Both methods present considerable environmental challenges, requiring careful consideration of energy sources and responsible mining practices to minimize their impact.

Which One Should You Choose?

The best choice between cloud mining and hardware mining depends on your individual circumstances and goals. Consider these factors:

Hardware mining offers greater control and potential profitability, but requires a significant upfront investment in equipment and expertise, along with ongoing maintenance and electricity costs. It’s ideal for those with technical skills, capital, and a tolerance for risk.

Cloud mining provides a lower barrier to entry with less technical expertise and lower upfront costs. However, profitability is often lower due to shared hashing power and potential scams. It is better suited for individuals with limited capital and technical knowledge seeking a simpler way to participate in cryptocurrency mining. Ultimately, a thorough cost-benefit analysis considering your resources and risk tolerance is crucial before making a decision.