Choosing the right crypto exchange can be daunting, given the sheer number of platforms available. This comprehensive guide helps you navigate the complexities of selecting a platform that best suits your individual needs as an investor. We’ll explore key factors such as security, fees, available cryptocurrencies, trading features, and user experience, empowering you to make an informed decision and confidently begin your crypto trading journey. Learn how to assess each platform’s strengths and weaknesses to ensure you find the perfect crypto exchange for your investment strategy.

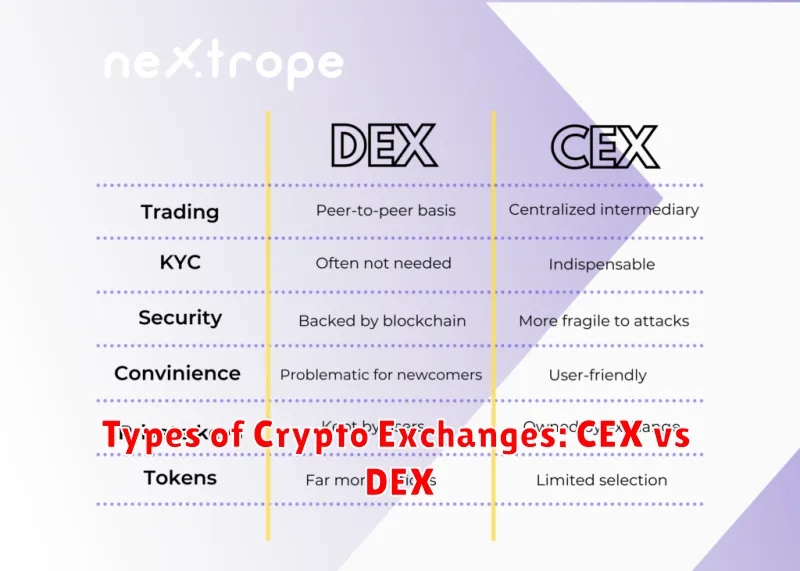

Types of Crypto Exchanges: CEX vs DEX

Choosing the right cryptocurrency exchange is crucial for a positive trading experience. A key factor in this decision is understanding the fundamental differences between the two main types of exchanges: Centralized Exchanges (CEXs) and Decentralized Exchanges (DEXs).

CEXs, like Coinbase or Binance, act as intermediaries. They hold users’ funds and facilitate trading. This offers convenience and generally higher liquidity, meaning it’s easier to buy and sell cryptocurrencies. However, this centralized nature introduces security risks, including the potential for hacking and platform-related issues. Users also typically need to undergo Know Your Customer (KYC) procedures.

DEXs, such as Uniswap or PancakeSwap, operate without a central authority. Users directly interact with smart contracts to trade, eliminating the need for intermediaries. This offers enhanced security and privacy as users retain control over their funds. However, liquidity can be lower on DEXs compared to CEXs, and the user experience can be more technically challenging for beginners. KYC procedures are generally not required on DEXs.

The best choice depends on your priorities. If convenience and high liquidity are paramount, a CEX might be suitable. If security and privacy are your top concerns, a DEX is worth considering. Weighing these factors carefully will help you select the exchange that best aligns with your needs and risk tolerance.

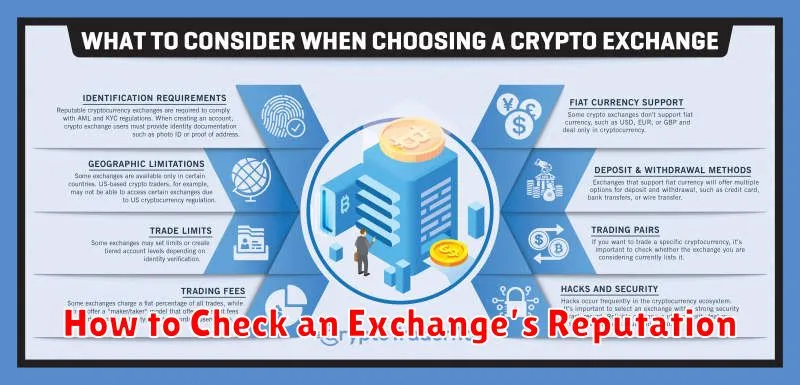

How to Check an Exchange’s Reputation

Checking an exchange’s reputation is crucial before entrusting your cryptocurrency. Begin by researching online reviews from multiple sources. Look for patterns in user feedback regarding security, fees, and customer support. Pay close attention to any mentions of significant security breaches or prolonged withdrawal delays.

Investigate the exchange’s regulatory compliance. A reputable exchange will usually be registered with relevant financial authorities and adhere to industry best practices. Look for evidence of security measures such as two-factor authentication (2FA), cold storage of funds, and regular security audits. Transparency regarding their security practices is a positive sign.

Consider the exchange’s track record and age. Longer-standing exchanges with a proven history of secure operations are generally preferred. Check for any significant negative news or controversies associated with the exchange. You can often find this information through a simple Google search.

Finally, compare the exchange’s reputation to its competitors. This provides context and helps determine whether its perceived reputation is justified. Consider using multiple sources to gain a well-rounded perspective before making a decision.

Understanding Trading Pairs and Liquidity

Choosing the right cryptocurrency exchange involves understanding trading pairs and liquidity. A trading pair represents two cryptocurrencies that can be exchanged for each other, such as BTC/USD (Bitcoin/US Dollar) or ETH/BTC (Ethereum/Bitcoin).

Liquidity refers to the ease with which an asset can be bought or sold without significantly impacting its price. A highly liquid trading pair has many buy and sell orders, allowing for quick and efficient trades with minimal price slippage. Low liquidity pairs, conversely, may result in wider spreads and difficulty executing trades at desired prices.

Consider the volume of trades for a given pair; higher volume generally indicates greater liquidity. Exchange size and reputation also play a role, as larger, more established exchanges tend to attract higher trading volumes and thus greater liquidity for many pairs.

Before selecting an exchange, research the available trading pairs and their liquidity. Prioritize exchanges offering the pairs you need with sufficient liquidity to execute your trades efficiently and minimize potential price impacts.

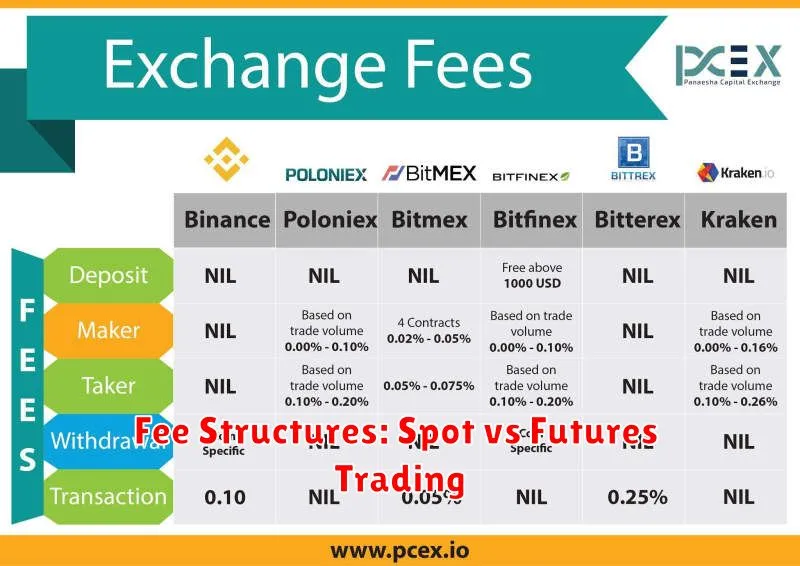

Fee Structures: Spot vs Futures Trading

Understanding fee structures is crucial when choosing a crypto exchange. Spot trading involves buying and selling cryptocurrencies at the current market price. Fees typically consist of trading fees (a percentage of the transaction value) and potentially withdrawal fees for transferring crypto off the exchange.

Futures trading, on the other hand, involves agreeing to buy or sell an asset at a future date at a predetermined price. Fees here are more complex. You’ll encounter trading fees, often lower than spot trading, but also funding rates (paid or received based on the market’s supply and demand for the contract), and potentially liquidation fees if your position is closed due to insufficient margin.

Key Differences: Spot trading offers simpler fee structures, while futures trading involves multiple fee components that can fluctuate. Carefully compare the fee schedules of different exchanges, considering your trading style and risk tolerance. Look for transparent fee breakdowns and consider the potential impact of funding rates on your overall profitability in futures trading.

Security Features to Look For

Choosing a secure crypto exchange is paramount. Look for exchanges that offer multi-factor authentication (MFA), requiring more than just a password to access your account. This significantly enhances security.

Cold storage is crucial. A significant portion of the exchange’s cryptocurrency should be stored offline, making it less vulnerable to hacking. Check for transparency in their storage methods.

Robust encryption is vital for protecting user data. The exchange should utilize advanced encryption techniques to safeguard sensitive information. Look for information about their security protocols.

Investigate the exchange’s security track record. Have they experienced any major security breaches in the past? A clean history demonstrates a commitment to security.

Consider exchanges with regular security audits performed by reputable third-party firms. This independent verification provides further assurance.

Finally, check if the exchange offers insurance or other forms of compensation in case of a security breach. This mitigates potential losses for users.

Best Crypto Exchanges in 2025

Predicting the best crypto exchanges in 2025 is challenging due to the market’s volatility and constant evolution. However, several factors will likely contribute to an exchange’s success. Security will remain paramount, with exchanges demonstrating robust measures against hacking and theft. Regulatory compliance will be increasingly important, as governments worldwide tighten their grip on the crypto space. User experience will also be a key differentiator, with platforms offering intuitive interfaces and excellent customer support gaining an edge.

Exchanges with a diverse range of cryptocurrencies and trading pairs will attract a wider user base. Low fees and fast transaction speeds will be highly competitive advantages. Finally, the availability of advanced trading tools and features, such as margin trading and derivatives, will cater to experienced traders. While specific names are difficult to predict with certainty, exchanges that prioritize these aspects are likely to thrive in 2025.

It’s crucial to remember that the cryptocurrency market is dynamic. The landscape of leading exchanges can shift rapidly based on technological advancements, regulatory changes, and market trends. Therefore, continuous monitoring and diligent research are essential for choosing a suitable platform.