Are you intrigued by the world of cryptocurrency and looking to delve into the exciting realm of Bitcoin mining? This comprehensive beginner’s guide will equip you with the essential knowledge to embark on your Bitcoin mining journey. We’ll cover everything from understanding the basics of Bitcoin mining hardware and software to navigating the complexities of mining pools and profitability calculations. Learn how to start Bitcoin mining safely and effectively, maximizing your potential returns while mitigating risks. Discover the step-by-step process and gain the confidence to successfully enter the competitive yet rewarding world of Bitcoin mining.

What is Bitcoin Mining?

Bitcoin mining is the process by which new bitcoins are created and added to the blockchain, a public, distributed ledger that records all bitcoin transactions. It involves solving complex computational mathematical problems using specialized hardware. Miners compete to solve these problems first, and the first to solve one receives a reward in the form of newly minted bitcoins and transaction fees.

This process is essential for securing the bitcoin network and verifying transactions. The computational power dedicated to mining maintains the integrity and security of the blockchain, making it extremely difficult to alter or tamper with past transactions. The difficulty of these problems is constantly adjusted to maintain a consistent rate of new bitcoin creation.

In essence, Bitcoin mining is a decentralized, competitive process that underpins the entire Bitcoin ecosystem. It ensures the network’s security, scalability, and trust.

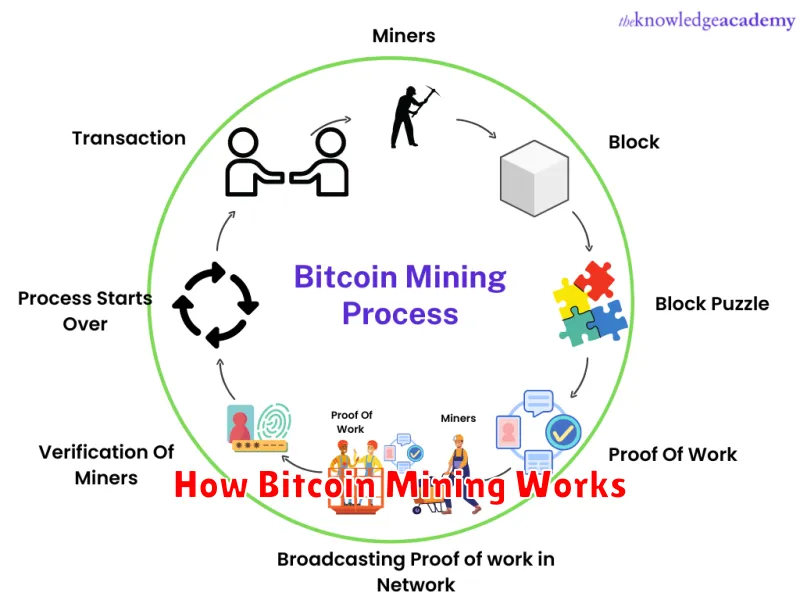

How Bitcoin Mining Works

Bitcoin mining is the process of verifying and adding transactions to the Bitcoin blockchain. This process is essential for maintaining the security and integrity of the Bitcoin network.

Miners use powerful computers to solve complex mathematical problems. The first miner to solve the problem gets to add the next block of transactions to the blockchain and receives a reward in Bitcoin. This reward is currently 6.25 BTC, and it halves roughly every four years.

The difficulty of these problems adjusts automatically to maintain a consistent block creation rate of approximately 10 minutes. As more miners join the network, the difficulty increases; conversely, if fewer miners participate, the difficulty decreases.

Hashing is a crucial part of this process. Miners use hashing algorithms to generate cryptographic hashes, which are used to verify the integrity of the transactions within a block. The goal is to find a hash that meets specific criteria, essentially solving the mathematical puzzle.

Proof-of-work is the underlying consensus mechanism of Bitcoin. This means miners must expend computational resources (energy) to validate transactions, preventing fraudulent activities and securing the network.

In short, Bitcoin mining is a competitive, energy-intensive process that underpins the entire Bitcoin ecosystem.

Necessary Hardware for Mining

Bitcoin mining requires specialized hardware capable of solving complex cryptographic problems. The most crucial component is the Application-Specific Integrated Circuit (ASIC) miner. These chips are designed specifically for Bitcoin mining and significantly outperform CPUs and GPUs in terms of hashing power.

Beyond the ASIC, you’ll need a power supply capable of handling the high power draw of the ASIC miner. These miners consume considerable electricity, so a robust and reliable power supply is essential. Cooling solutions, such as fans or even liquid cooling systems, are also crucial to prevent overheating and ensure optimal performance.

Finally, you will need a motherboard compatible with your chosen ASIC miner and power supply, as well as sufficient RAM and storage to operate the mining software. The exact specifications will depend on the specific miner you choose.

Setting Up a Crypto Mining Rig

Setting up a cryptocurrency mining rig requires careful planning and selection of components. Begin by choosing a suitable graphics card (GPU), as these are the core of mining operations. Consider factors like hash rate, power consumption, and price-performance ratio when selecting GPUs. Multiple GPUs are typically used for optimal efficiency.

Next, you’ll need a motherboard with enough PCI-e slots to accommodate your chosen GPUs. Ensure the motherboard is compatible with your CPU, which should be powerful enough to handle the mining software and manage the GPUs. A robust power supply unit (PSU) is crucial to provide sufficient power to all components, with enough headroom to prevent system instability. Consider the total power draw of your GPUs and other components when selecting a PSU.

Other necessary components include RAM, an SSD or NVMe drive for faster operating speeds, and a suitable computer case that can effectively cool all components. Proper cooling is vital to prevent overheating and maintain optimal performance, potentially requiring additional fans or liquid cooling systems.

Finally, you need to install the operating system and the appropriate mining software. Configure the software to match your rig’s specifications and connect to a mining pool to maximize profitability. Remember to factor in the ongoing costs of electricity, which can significantly impact the profitability of your mining operation.

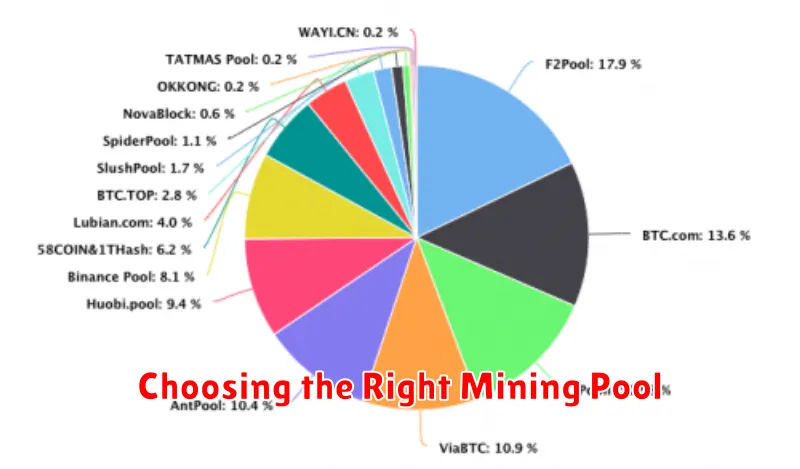

Choosing the Right Mining Pool

Joining a mining pool is crucial for most Bitcoin miners, as it significantly increases your chances of earning rewards. Pools combine the hashing power of many miners, allowing for more frequent block discoveries and payouts.

When selecting a pool, consider these key factors:

- Pool size and hash rate: Larger pools offer more consistent payouts but may have higher competition.

- Payout system: Understand the payment methods (e.g., PPS, PPLNS, PROP) and their implications on your earnings.

- Fees: Compare the pool’s fees, as they can impact your profitability.

- Server location and uptime: Choose a pool with reliable servers located geographically close to you to minimize latency.

- Reputation and community support: Look for established pools with a positive reputation and active community support.

Researching different pools and comparing their performance metrics is essential before making a decision. Your choice will ultimately impact your mining efficiency and profitability.

Energy Consumption and Profitability

Bitcoin mining is an energy-intensive process. The computational power required to solve complex cryptographic puzzles consumes significant electricity. Your profitability is directly tied to the cost of electricity and the reward for successfully mining a block (which includes transaction fees and the newly-minted Bitcoin).

Electricity costs are a major operational expense. Mining in areas with low electricity prices is crucial for profitability. Consider the overall cost per kilowatt-hour (kWh), including any taxes or surcharges. High electricity costs can quickly erase any potential profit.

The Bitcoin price also plays a vital role. A higher Bitcoin price increases the value of your mining reward, making mining more profitable. Conversely, a lower Bitcoin price can make mining unprofitable, even with low electricity costs.

Mining difficulty, which adjusts to maintain a consistent block generation rate, also affects profitability. A higher difficulty requires more computational power, increasing energy consumption and potentially reducing your chances of successfully mining a block.

Therefore, carefully assess your electricity costs and the current Bitcoin price before investing in Bitcoin mining hardware. Thorough research and accurate calculations are critical to determining whether mining will be a profitable venture for you. Consider using online mining profitability calculators to estimate potential returns.

Security Risks and How to Avoid Them

Bitcoin mining, while potentially profitable, exposes you to several security risks. These risks primarily stem from the significant computing power and valuable cryptocurrency involved.

One major concern is malware. Mining software can be easily infected, allowing hackers to steal your cryptocurrency or use your hardware for malicious purposes. Always download software from reputable sources and run regular virus scans.

Hardware theft is another significant risk. Mining rigs, often containing expensive GPUs, are attractive targets for thieves. Secure your mining operation physically, perhaps with alarms or surveillance, and ensure your location is well-lit and secure.

Electricity theft can also be a problem, especially with high-power mining operations. Ensure proper electrical installation and usage to avoid fire hazards and unauthorized access to your power supply. Consider using a dedicated circuit for your mining rig.

Finally, software vulnerabilities in your mining software or operating system can create openings for hackers. Keep your software updated with the latest security patches to minimize these vulnerabilities. Regularly back up your data to prevent data loss due to security breaches.

By taking these preventative measures, you can significantly reduce the security risks associated with Bitcoin mining and protect your investment.

Future of Bitcoin Mining

The future of Bitcoin mining is complex and multifaceted, dependent on several intertwined factors. One key aspect is the ongoing technological advancements in mining hardware. More efficient ASICs (Application-Specific Integrated Circuits) will continue to emerge, potentially increasing profitability for large-scale operations while making it harder for smaller miners to compete.

Environmental concerns are also playing an increasingly significant role. The high energy consumption of Bitcoin mining is driving a shift towards sustainable energy sources like renewable energy. Regulations aimed at curbing energy usage are likely to become more prevalent, influencing the location and operation of mining farms.

Furthermore, the evolution of mining algorithms and the potential emergence of new consensus mechanisms could impact the profitability and accessibility of Bitcoin mining. Increased competition from institutional miners and the rise of mining pools will continue to reshape the landscape.

Finally, the overall price volatility of Bitcoin itself remains a major uncertainty. Fluctuations in Bitcoin’s value directly impact the profitability of mining, making it a highly speculative endeavor.