Confused by the buzz around cryptocurrency? This complete beginner’s guide will demystify the world of digital currencies like Bitcoin and Ethereum. Learn the basics of blockchain technology, understand how crypto trading works, and discover the potential risks and rewards of investing in this exciting and rapidly evolving market. Whether you’re a complete novice or just looking for a refresher, this comprehensive guide will equip you with the knowledge you need to navigate the complex landscape of cryptocurrency investing.

Understanding Digital Currencies

Digital currencies represent a fundamental shift in how we think about money. Unlike traditional fiat currencies issued and regulated by governments, digital currencies are typically decentralized, meaning they are not controlled by a single entity. This decentralization is often achieved through blockchain technology, a distributed ledger that records and verifies transactions across a network of computers.

Key characteristics of digital currencies include their digital nature (existing only as electronic data), the potential for faster and cheaper transactions compared to traditional systems, and the ability to operate globally without the need for intermediaries like banks. However, they also often present unique challenges, including volatility, security concerns, and regulatory uncertainty.

Several types of digital currencies exist, with cryptocurrencies being the most well-known. Cryptocurrencies like Bitcoin rely on cryptography for security and employ blockchain technology to maintain a transparent and tamper-proof record of transactions. Other forms include stablecoins, which aim to minimize price volatility by pegging their value to a stable asset like the US dollar, and central bank digital currencies (CBDCs), which are digital versions of fiat currencies issued by central banks.

Understanding the differences between these various types of digital currencies is crucial for navigating the evolving landscape of digital finance. The technology behind digital currencies continues to evolve rapidly, leading to new innovations and challenges.

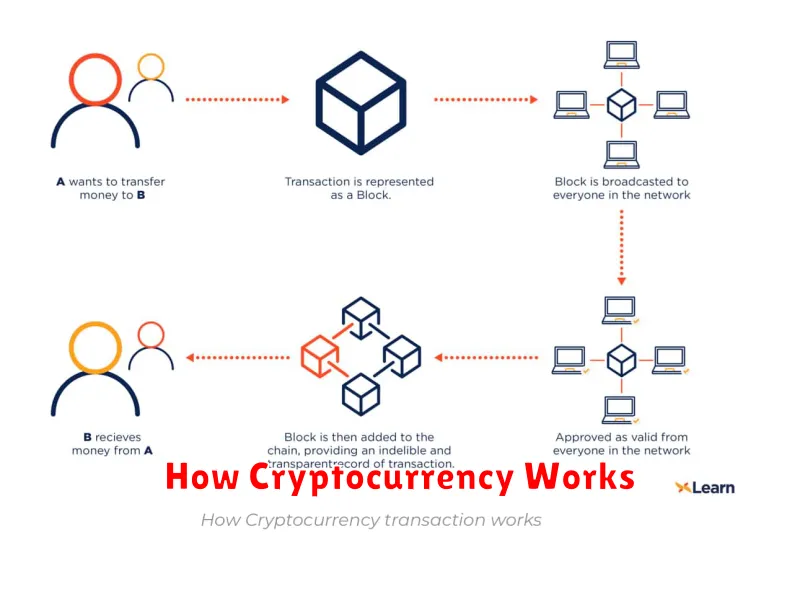

How Cryptocurrency Works

Cryptocurrencies operate on a technology called blockchain, a decentralized, public digital ledger recording all transactions. Each transaction is grouped into a “block,” which is then added to the chain after verification.

Verification involves a process called mining. Miners use powerful computers to solve complex mathematical problems. The first miner to solve the problem adds the new block to the blockchain and is rewarded with newly minted cryptocurrency. This process secures the network and prevents fraud.

Transactions are digitally signed using cryptographic keys, ensuring security and authenticity. These keys, a public and a private key, allow users to send and receive cryptocurrency without intermediaries like banks.

The decentralized nature of cryptocurrency means no single entity controls it. This contrasts sharply with traditional financial systems, making cryptocurrencies potentially more resistant to censorship and single points of failure. However, it also means that users are responsible for the security of their own funds.

The value of a cryptocurrency is determined by supply and demand in the market, much like traditional currencies. However, the market is often highly volatile and influenced by factors such as news, adoption rates, and regulatory changes.

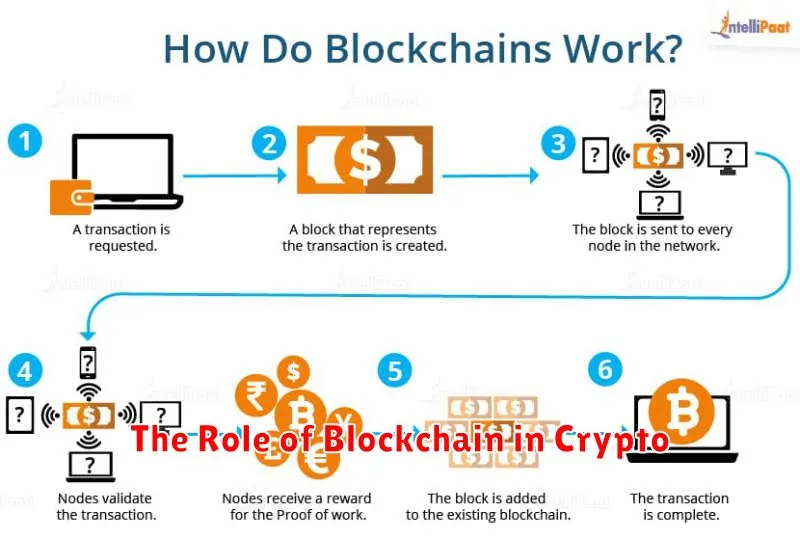

The Role of Blockchain in Crypto

Blockchain is the foundational technology underpinning most cryptocurrencies. It acts as a decentralized, distributed ledger that records all cryptocurrency transactions publicly and permanently.

This distributed nature means no single entity controls the blockchain, enhancing security and transparency. Each transaction is verified by a network of computers (nodes) before being added to the blockchain, making it extremely difficult to alter or delete records.

The immutability of the blockchain ensures the integrity of cryptocurrency transactions, preventing fraud and double-spending. This fundamental feature builds trust and confidence in the system, without relying on a central authority.

In essence, the blockchain provides the secure and transparent infrastructure necessary for cryptocurrencies to function effectively. It’s the key to their decentralized and trustless nature.

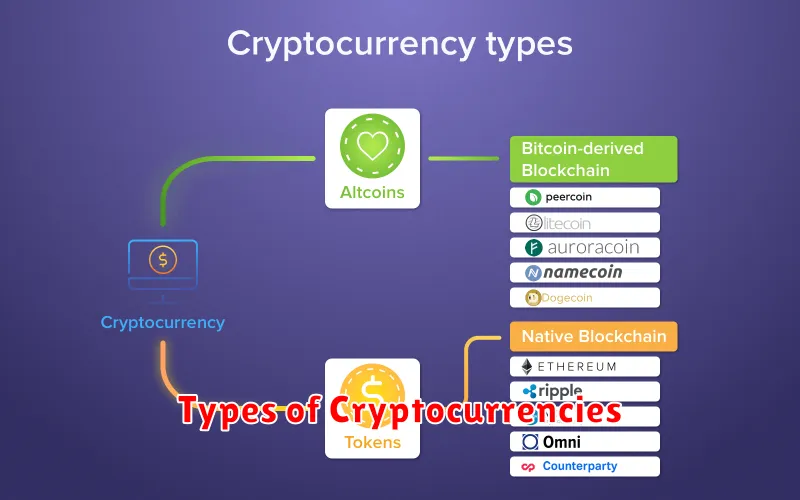

Types of Cryptocurrencies

Cryptocurrencies are broadly categorized, though lines can blur. A primary distinction lies in their purpose and underlying technology.

Bitcoin and other similar cryptocurrencies are often called “payment cryptocurrencies.” Their primary function is to facilitate peer-to-peer transactions, acting as a digital form of cash.

Altcoins are alternative cryptocurrencies to Bitcoin. This is a broad category encompassing various types, many of which aim to improve upon Bitcoin’s functionality or address perceived limitations. Some altcoins focus on faster transaction speeds or lower fees. Others may incorporate advanced features like smart contracts or decentralized applications (dApps).

Stablecoins are designed to maintain a relatively stable value, usually pegged to a fiat currency like the US dollar or a precious metal like gold. This is achieved through various mechanisms, aiming to reduce the volatility often associated with cryptocurrencies.

Security tokens represent ownership in a real-world asset, such as stocks, bonds, or real estate. These tokens are often used in Security Token Offerings (STOs), which are regulated offerings intended to adhere to securities laws.

Meme coins, like Dogecoin, are largely driven by social media trends and community sentiment rather than any specific underlying utility or technology. Their price is highly volatile and susceptible to market manipulation.

This classification is not exhaustive, and new types of cryptocurrencies continue to emerge, blurring lines between categories. The cryptocurrency landscape is constantly evolving.

Crypto Wallets: Hot vs Cold Storage

Understanding how to store your cryptocurrency is crucial. There are two main types of wallets: hot and cold wallets.

Hot wallets, such as mobile apps or web wallets, offer convenient access to your funds. However, their constant internet connection makes them more vulnerable to hacking and theft. Think of them like checking accounts – easily accessible but less secure.

Cold wallets, conversely, are offline devices like hardware wallets or even a paper wallet. They provide significantly enhanced security as they are not connected to the internet. The downside is reduced accessibility. Think of them as a safe deposit box – secure but requires more effort to access.

The choice between hot and cold storage depends on your individual needs and risk tolerance. For smaller amounts or frequent transactions, a hot wallet might suffice. For larger holdings or long-term investment, a cold wallet is the recommended approach for better security.

How to Buy and Sell Crypto

Buying and selling cryptocurrency involves several steps. First, you need to choose a reputable cryptocurrency exchange. These platforms allow you to buy, sell, and trade various cryptocurrencies. Research different exchanges to compare fees and available cryptocurrencies.

Next, you’ll need to create an account on your chosen exchange. This typically involves providing personal information and verifying your identity. Security is paramount; choose a strong password and enable two-factor authentication.

Once your account is set up, you’ll need to fund your account. Most exchanges accept bank transfers, debit/credit cards, or even other cryptocurrencies. The method you choose will affect the speed of your deposit.

After funding your account, you can buy your chosen cryptocurrency. The exchange will display the current market price, and you specify the amount you wish to purchase. After completing the transaction, your cryptocurrency will be added to your exchange wallet.

Selling cryptocurrency follows a similar process. You select the cryptocurrency you wish to sell and specify the amount. The exchange will then process the sale, transferring the funds (usually fiat currency) back to your account.

Remember to always practice good security habits, including using strong passwords, enabling two-factor authentication, and storing your cryptocurrency in secure wallets. Understand that cryptocurrency markets are volatile, and prices can fluctuate significantly. Only invest what you can afford to lose.

Understanding Crypto Market Volatility

The cryptocurrency market is known for its extreme volatility. Unlike traditional markets, crypto prices can fluctuate dramatically in short periods, experiencing significant gains and losses within hours or even minutes.

Several factors contribute to this volatility. Speculation plays a major role, as the market is relatively young and heavily influenced by investor sentiment and news events. Regulation, or lack thereof, in many jurisdictions creates uncertainty. Technological advancements and adoption rates also impact prices.

Limited liquidity in some crypto markets exacerbates price swings. A smaller trading volume means that even relatively small buy or sell orders can have a disproportionate effect on the price.

Understanding this inherent volatility is crucial for anyone considering investing in cryptocurrencies. It’s vital to have a long-term perspective and a risk tolerance suitable for such a volatile market. Never invest more than you can afford to lose.

The Importance of Private Keys and Security

Understanding private keys is crucial to grasping cryptocurrency security. A private key is a secret code, essentially a long string of characters, that gives you sole control over your cryptocurrency holdings. It’s akin to a password for your digital assets.

Security hinges entirely on keeping your private key confidential. If someone gains access to your private key, they can access and transfer your cryptocurrency without your permission. This makes it vital to store your private keys securely, ideally using offline storage methods like hardware wallets.

Never share your private key with anyone, including customer support representatives from exchanges or cryptocurrency companies. Legitimate entities will never request this information. Losing your private key means losing your cryptocurrency permanently; there’s no recovery process.

Strong security practices include using strong passwords, enabling two-factor authentication where available, regularly updating software, and being wary of phishing scams that attempt to steal your private keys.

Crypto Mining vs. Crypto Staking

Crypto mining and crypto staking are two different ways to earn cryptocurrency, but they involve vastly different processes and levels of technical expertise.

Crypto mining involves solving complex mathematical problems to verify and add transactions to a blockchain. This requires specialized hardware (ASICs for Bitcoin, GPUs for others) and significant electricity consumption. The reward is newly minted cryptocurrency and transaction fees. The process is computationally intensive and highly competitive, with profitability depending on the value of the cryptocurrency and energy costs.

Crypto staking, on the other hand, is a more passive process. It involves locking up your cryptocurrency in a wallet to support the security and validation of a blockchain using a Proof-of-Stake (PoS) consensus mechanism. This typically requires less energy and specialized equipment than mining. Stakers earn rewards proportionate to their stake and the time it’s locked up. The rewards are generally paid out in the cryptocurrency itself.

In short, mining is an active, energy-intensive process with potentially high rewards but significant upfront investment and operational costs, while staking is a more passive, energy-efficient process with lower potential rewards but minimal setup costs. The best choice depends on individual resources, technical skills, and risk tolerance.

Future Trends in Cryptocurrency

The future of cryptocurrency is dynamic and full of potential. Several key trends are shaping its evolution.

Increased Regulation is expected globally, aiming to balance innovation with consumer protection and preventing illicit activities. This will likely lead to greater legitimacy and mainstream adoption.

Decentralized Finance (DeFi) will continue its rapid expansion, offering innovative financial services beyond traditional institutions. This includes lending, borrowing, and trading without intermediaries.

Interoperability between different blockchain networks will become increasingly important, allowing seamless transfer of assets and data across platforms. This enhances efficiency and utility.

The Metaverse and Non-Fungible Tokens (NFTs) are expected to further integrate with cryptocurrencies, creating new opportunities for digital ownership and virtual economies.

Sustainable Cryptocurrencies, using energy-efficient consensus mechanisms, will gain traction as environmental concerns grow. This addresses a major criticism of some existing cryptocurrencies.

Institutional Adoption will likely increase, with more corporations and financial institutions exploring and integrating cryptocurrencies into their operations.

While predicting the future is inherently uncertain, these trends suggest a future where cryptocurrencies play a significant role in the global financial landscape, becoming more integrated, regulated, and sustainable.