Converting your mined cryptocurrency into fiat currency can seem daunting, but with the right knowledge and approach, it’s a straightforward process. This guide will walk you through the steps of safely and efficiently converting your mined Bitcoin, Ethereum, or other digital assets into USD, EUR, or other national currencies. We’ll cover choosing the best crypto exchange, understanding fees and tax implications, and securing your crypto wallet to ensure a smooth and secure transaction.

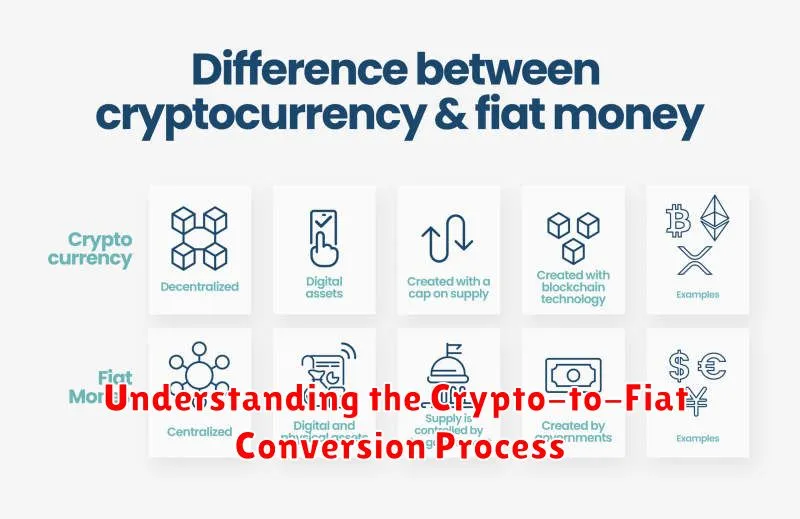

Understanding the Crypto-to-Fiat Conversion Process

Converting mined cryptocurrency into fiat currency involves exchanging your digital assets for traditional money like US dollars, Euros, or Yen. This process typically requires using a cryptocurrency exchange or a peer-to-peer (P2P) platform.

Cryptocurrency exchanges are online platforms that facilitate the buying and selling of cryptocurrencies. You’ll need to create an account, verify your identity, and deposit your mined cryptocurrency. Once deposited, you can place an order to sell your cryptocurrency for your chosen fiat currency. The exchange will then transfer the fiat equivalent to your linked bank account or payment method.

P2P platforms connect you directly with buyers who want to purchase your cryptocurrency using fiat currency. These platforms typically handle the transaction, offering escrow services to protect both parties. You’ll agree on a price and payment method with the buyer, and the platform will facilitate the transfer once the cryptocurrency is released.

The conversion process involves several steps including verifying your identity (KYC/AML compliance), transferring your crypto to the exchange or P2P platform, placing a sell order at a specific price, and finally receiving the fiat currency in your designated account. The exact steps and timelines vary depending on the platform and chosen method.

Fees are associated with both exchanges and P2P platforms, including transaction fees, deposit fees, and potentially withdrawal fees. It’s essential to compare fees across different platforms before initiating a conversion to minimize costs.

Security is paramount. Choose reputable and well-established exchanges and P2P platforms with a strong track record. Always protect your account credentials and follow best practices for online security.

Choosing the Best Exchange for Selling Crypto

Selecting the right cryptocurrency exchange is crucial for efficiently converting your mined crypto into fiat currency. Security should be your top priority. Look for exchanges with robust security measures, including two-factor authentication (2FA) and cold storage for a significant portion of their assets. Research the exchange’s history and reputation; check for any past security breaches or controversies.

Fees are another critical factor. Compare trading fees, withdrawal fees, and deposit fees across different platforms. Some exchanges charge higher fees for certain cryptocurrencies or payment methods. Factor in the total cost, including any potential hidden fees.

Liquidity is essential, especially for larger transactions. Choose an exchange with high trading volume for your specific cryptocurrency to ensure you can sell quickly and at a fair price. Low liquidity can result in slippage—the difference between the expected price and the actual execution price.

User interface and experience also matter. A user-friendly platform makes the selling process smoother and more efficient. Consider factors such as ease of navigation, order placement, and customer support responsiveness.

Finally, consider the available payment methods. Different exchanges offer various fiat currency withdrawal options, such as bank transfers, wire transfers, or debit/credit card payouts. Select an exchange that supports your preferred method.

By carefully evaluating these key factors—security, fees, liquidity, user experience, and payment options—you can choose the best exchange for your needs and convert your mined cryptocurrency into fiat currency safely and efficiently.

Using Peer-to-Peer (P2P) Trading

Peer-to-peer (P2P) trading platforms offer a direct method for converting mined cryptocurrency into fiat currency. These platforms connect buyers and sellers directly, eliminating the need for intermediaries like exchanges.

Advantages of using P2P platforms include potentially higher privacy, as transactions are often not subject to the same Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations as exchanges. They can also offer more payment options, including bank transfers, mobile payments, and cash.

However, risks associated with P2P trading include the possibility of fraud or scams if not properly vetted. Users should carefully select reputable platforms and conduct due diligence on their trading partners. Security is also paramount; users must protect their personal information and use secure payment methods.

The process typically involves creating an account on a chosen P2P platform, creating an advertisement offering your cryptocurrency for sale, negotiating a price with a buyer, and completing the transaction according to the platform’s guidelines. Always prioritize secure communication channels and adhere to the platform’s security protocols.

Withdrawing to a Bank Account

Once you’ve exchanged your mined cryptocurrency for fiat currency on an exchange, the next step is transferring those funds to your bank account. This process typically involves linking your bank account to your exchange account. Verify all account details carefully before initiating a withdrawal to prevent errors.

Most exchanges offer various withdrawal methods, including wire transfers, ACH transfers, or debit card withdrawals. Choose the method that best suits your needs and bank’s capabilities. Review the associated fees and processing times for each option; these can vary significantly.

After selecting your withdrawal method and entering the necessary information, submit your withdrawal request. The processing time can range from a few hours to several business days, depending on the chosen method and the exchange’s policies. Monitor your bank account for the credited funds.

Always ensure you’re using a reputable and secure exchange to minimize the risk of fraud or loss of funds. Maintain detailed records of all transactions for your accounting purposes.

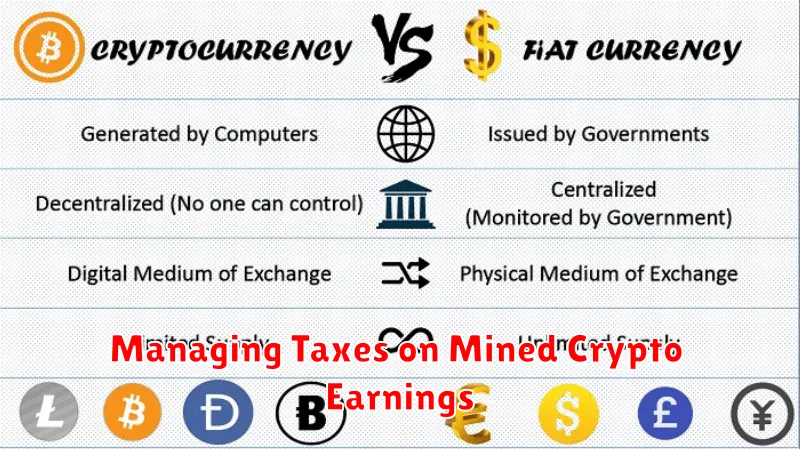

Managing Taxes on Mined Crypto Earnings

Mining cryptocurrency generates taxable income. The IRS considers mined crypto as ordinary income at the fair market value (FMV) on the date it’s mined. This means you’ll need to report this income on your tax return, regardless of whether you’ve sold the cryptocurrency.

Accurate record-keeping is crucial. Maintain detailed records of your mining activities, including the date of mining, the amount of cryptocurrency mined, and the FMV at the time of mining. This documentation will be essential when filing your taxes.

The tax implications can be complex, particularly concerning capital gains taxes when you eventually sell the mined cryptocurrency. The difference between your selling price and the FMV at the time of mining will determine your capital gains. This is subject to various tax brackets depending on your holding period.

Consider consulting a tax professional experienced in cryptocurrency taxation. They can provide personalized guidance based on your specific situation and ensure you comply with all relevant tax laws. The complexities of crypto taxation require expertise to navigate accurately.