Are you looking to generate passive income with your cryptocurrency holdings? Staking crypto offers a compelling opportunity to earn rewards simply by holding and securing your digital assets. This guide will walk you through the process of staking crypto, explaining the various methods, risks, and potential rewards involved in generating a consistent passive income stream. Learn how to safely and effectively stake your crypto and unlock the potential for significant returns.

What is Crypto Staking?

Crypto staking is a process where you lock up your cryptocurrency holdings in a blockchain’s validation process to earn rewards. Unlike mining, which requires significant computing power, staking typically only requires holding a certain amount of cryptocurrency.

By staking, you essentially help secure the network and are rewarded with newly minted coins or transaction fees. The specific mechanisms and rewards vary depending on the cryptocurrency and the chosen staking method.

Staking is generally considered a more environmentally friendly and energy-efficient way to earn passive income compared to proof-of-work crypto mining.

The amount of reward earned from staking is usually determined by factors such as the amount of cryptocurrency staked, the validator’s reputation, and the overall network activity. It’s important to research and understand these factors before committing to staking.

How Does Staking Work?

Staking is a process that allows cryptocurrency holders to earn passive income by locking up their tokens and validating transactions on a blockchain network. Unlike mining, which typically requires specialized hardware, staking is more accessible and often requires only a crypto wallet and a certain amount of the chosen cryptocurrency.

The process generally involves delegating your tokens to a validator node. These nodes are responsible for verifying and adding new blocks of transactions to the blockchain. In return for securing the network and helping maintain its integrity, validators (and the stakers who delegate to them) receive rewards in the form of newly minted cryptocurrency or transaction fees.

The amount of reward varies depending on several factors, including the specific cryptocurrency, the amount of tokens staked, the network’s consensus mechanism, and the validator’s performance. Some networks utilize a Proof-of-Stake (PoS) consensus mechanism, where the more tokens staked, the higher the chance of being selected to validate transactions and earn rewards.

It’s important to note that staking involves risks. The value of your staked cryptocurrency can fluctuate, and there’s a risk of losing your tokens if the validator node you’ve chosen is compromised or malfunctions. Thorough research and careful selection of a reputable validator are crucial before participating in staking.

Best Cryptocurrencies for Staking

Choosing the best cryptocurrency for staking depends on several factors, including your risk tolerance, technical expertise, and desired return. However, some consistently rank highly for their staking rewards and network security.

Ethereum (ETH): A leading contender, Ethereum offers staking rewards through its proof-of-stake (PoS) consensus mechanism. While requiring a significant initial investment, the potential returns and network stability make it attractive to many. Note: Staking ETH requires understanding smart contracts and associated risks.

Cardano (ADA): Known for its robust and scalable blockchain, Cardano offers a relatively straightforward staking process with competitive rewards. It’s often considered more beginner-friendly than Ethereum.

Solana (SOL): Solana boasts high transaction speeds and low fees, making it a popular choice. Staking Solana can offer substantial rewards, but its relatively newer ecosystem presents a slightly higher level of risk.

Cosmos (ATOM): Cosmos is an interoperable blockchain ecosystem. Staking ATOM offers decent returns and contributes to the security of the network. Its multi-chain nature provides diversification opportunities.

Polkadot (DOT): Polkadot is another interoperable blockchain platform. Staking DOT allows you to participate in the network’s governance and earn rewards. It has a strong development team and a vibrant community.

Important Disclaimer: The cryptocurrency market is highly volatile. Staking rewards can fluctuate, and the value of your staked cryptocurrency can decrease. Thoroughly research any cryptocurrency before staking and only invest what you can afford to lose.

Centralized vs Decentralized Staking

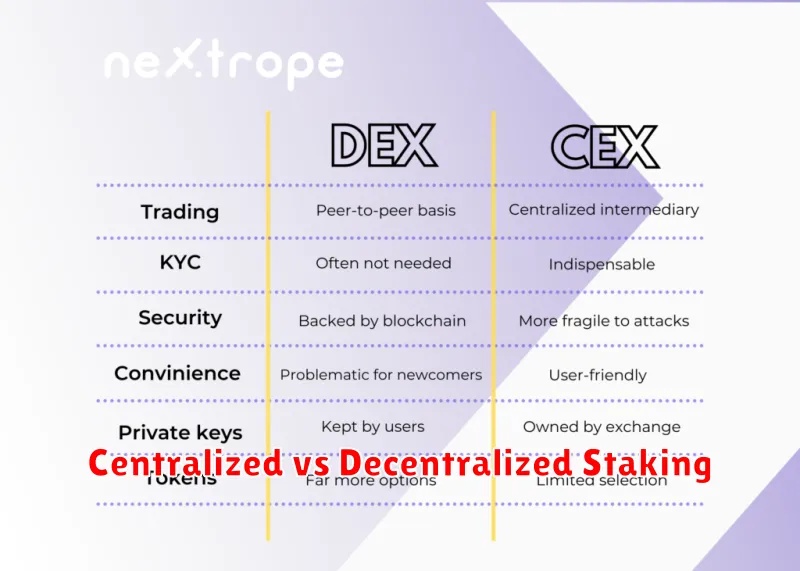

Staking your cryptocurrency offers a path to passive income, but the method you choose significantly impacts your experience. The core difference lies in whether you delegate your staking responsibilities to a third party (centralized) or manage them independently (decentralized).

Centralized staking typically involves platforms that pool resources from many users. This offers ease of use and often requires minimal technical knowledge. However, you relinquish control over your assets, introducing potential counterparty risk. The platform itself could be compromised or go bankrupt, impacting your investment.

Decentralized staking, in contrast, grants you direct control over your crypto. You manage the process yourself, often requiring more technical expertise and using a personal wallet. Though potentially more complex, this approach offers greater security as you retain custody of your funds. However, it may also be more time-consuming.

The choice depends on your priorities. Centralized staking prioritizes convenience, while decentralized staking emphasizes security and control. Carefully assess your comfort level with technology and risk tolerance when making your decision.

Staking Rewards: How Much Can You Earn?

Staking rewards vary significantly depending on several key factors. The type of cryptocurrency being staked plays a crucial role, with some offering significantly higher returns than others. Network demand also influences rewards; higher demand often leads to lower returns as more people compete for the limited rewards pool. The amount staked can also impact your earnings; some platforms offer tiered reward systems where larger stakes receive higher percentages.

Validators, those who operate the network’s validation nodes, generally earn more than delegators, those who stake their tokens with validators. However, validation requires significant technical expertise and resources. Inflation rates of the cryptocurrency also directly affect rewards; higher inflation generally means higher potential returns for stakers.

Finally, platform fees and minimum staking periods can impact your overall earnings. Always thoroughly research a platform’s terms and conditions to understand all associated costs and potential reductions to your rewards. It’s impossible to give a definitive answer to “how much you can earn,” as it is highly dependent on the variables mentioned above. However, potential returns can range from a few percent annually to much higher percentages, depending on the specific project and market conditions.

Risks of Crypto Staking

While crypto staking offers the potential for passive income, it’s crucial to understand the inherent risks. These risks are not insignificant and should be carefully considered before engaging in staking.

One primary risk is loss of principal. The value of your staked cryptocurrency can fluctuate significantly, potentially resulting in losses even if the staking rewards are positive. Market volatility is a major factor affecting the overall profitability of staking.

Security risks are also prevalent. Choosing a reputable and secure staking provider is critical. Using untrusted platforms or poorly secured wallets can lead to the loss of your staked assets due to hacks or other security breaches. Furthermore, the smart contract risk involved in many staking protocols means that vulnerabilities could lead to significant losses.

Illiquidity is another key consideration. Staked assets are typically locked for a specific period, limiting your ability to quickly sell them if needed. This can be particularly problematic during market downturns.

Regulatory uncertainty presents an additional risk. The regulatory landscape for cryptocurrencies is constantly evolving, and changes could impact the legality and tax implications of staking activities.

Finally, there’s the risk of slashing in some Proof-of-Stake networks. This refers to penalties incurred for actions such as downtime or participation in malicious activities. Understanding the specific slashing conditions of the chosen network is paramount.

Best Staking Platforms in 2025

Predicting the absolute “best” staking platforms in 2025 is challenging due to the rapidly evolving cryptocurrency landscape. However, several factors will likely contribute to a platform’s success. Security will remain paramount, with platforms needing robust systems to protect user assets. Ease of use and a user-friendly interface will be crucial for attracting a wider user base. Transparency in fees and operations will build trust. High APY (Annual Percentage Yield), while important, should be considered alongside the security and reliability of the platform.

Platforms offering a diverse range of staking options for various cryptocurrencies will likely be more competitive. The ability to stake multiple assets through a single platform offers convenience. Support for various consensus mechanisms (Proof-of-Stake, Delegated Proof-of-Stake, etc.) expands the available staking opportunities. Finally, a strong reputation and track record, including regulatory compliance where applicable, will be key differentiating factors.

While specific names are difficult to predict with certainty for 2025, platforms demonstrating these characteristics are likely to be considered among the best. Continuous monitoring of market trends and platform updates will be crucial for users to identify reliable and high-performing staking options as the space evolves. Thorough research and due diligence remain essential before choosing a staking platform.

The Future of Crypto Staking

The future of crypto staking hinges on several key factors. Increased institutional adoption will likely drive greater demand and sophistication in staking services. We can expect to see more robust and user-friendly staking platforms emerge, catering to both individual and institutional investors.

Technological advancements, such as improved consensus mechanisms and layer-2 scaling solutions, will likely increase the efficiency and security of staking. This could lead to higher rewards and lower transaction fees for stakers. Furthermore, the development of decentralized finance (DeFi) protocols specifically designed for staking will likely create more innovative and flexible staking options.

Regulatory clarity is also crucial. As governments worldwide grapple with regulating cryptocurrencies, clearer frameworks governing staking activities will provide greater certainty and encourage broader participation. However, increased regulation could also lead to more stringent compliance requirements for staking platforms.

Finally, the long-term sustainability of proof-of-stake (PoS) networks and the overall adoption of PoS as a dominant consensus mechanism will significantly impact the future of crypto staking. Widespread adoption of PoS would solidify staking’s role as a core component of the crypto ecosystem.